China's Belt and Road Initiative saw contracts surge 75%

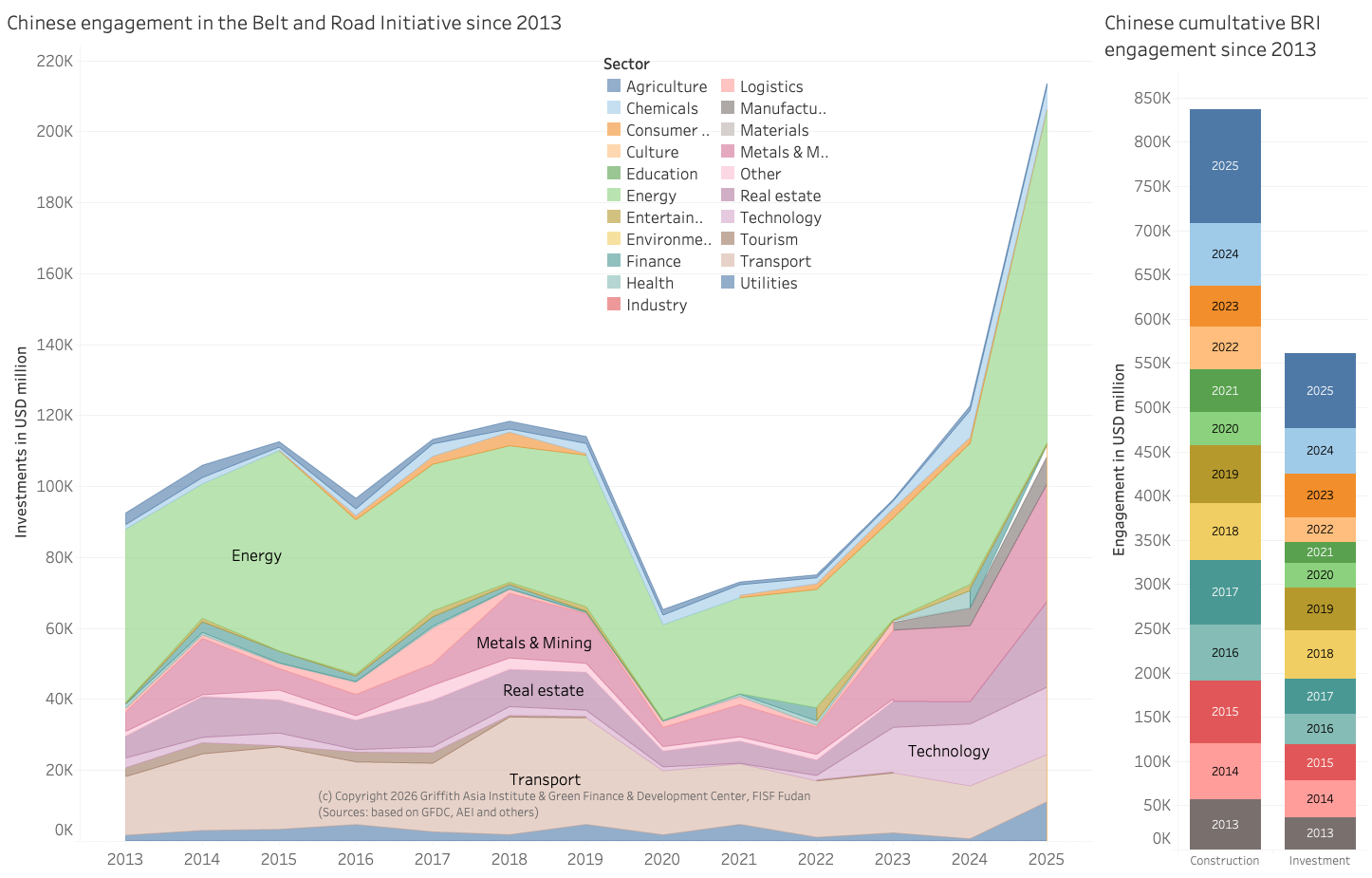

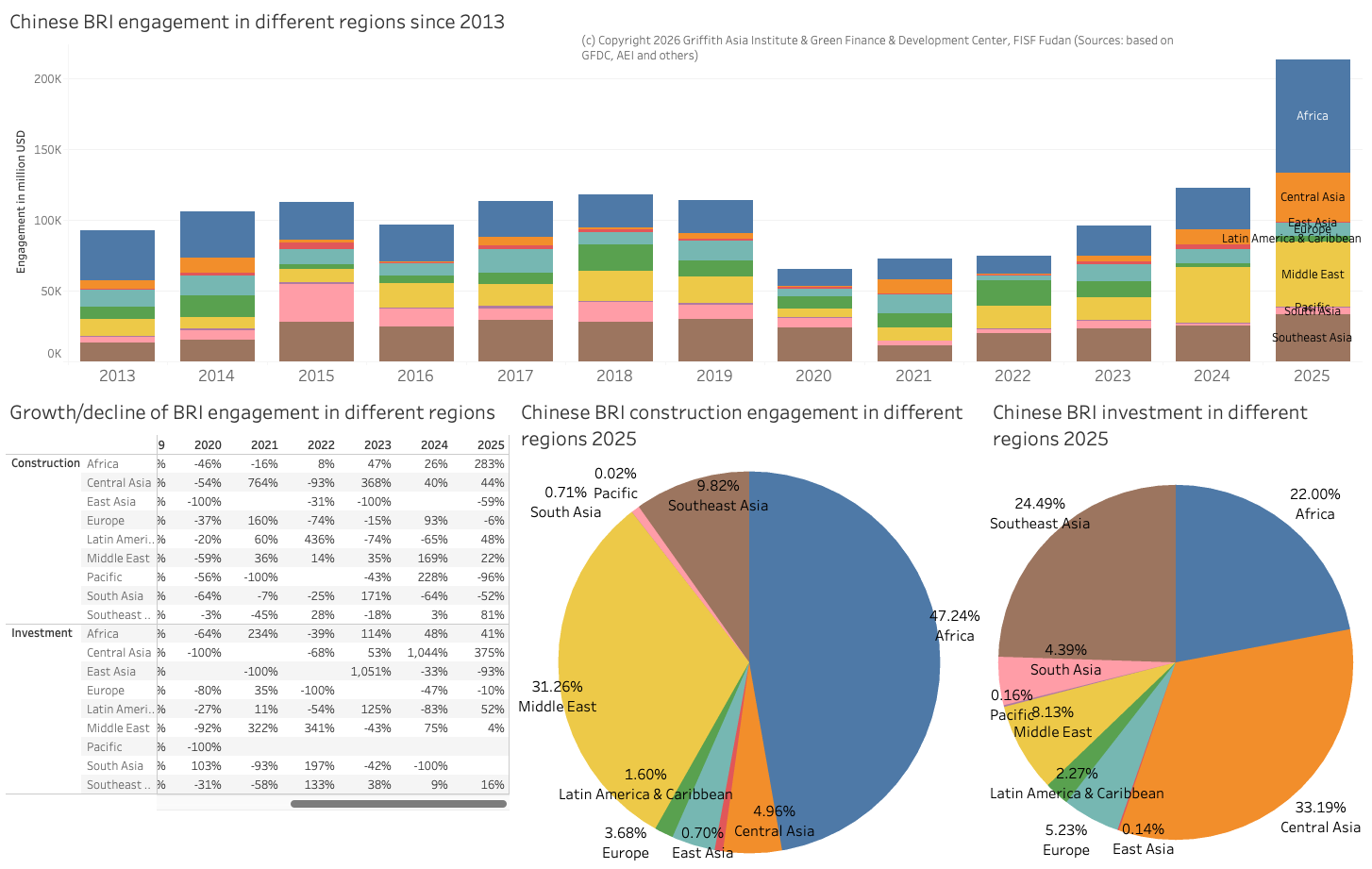

China's Belt and Road Initiative (BRI) saw new investment and construction contracts surge 75% in 2025 to a record $213.5 billion, up from $122.6 billion the previous year, according to a joint study by Griffith University and Shanghai's Green Finance & Development Center. Beijing signed 350 deals last year, compared with 293 in 2024.

The increase occurred amid US-China tensions over trade, technology, and supply chains, as well as disruptions from US military actions affecting global energy markets. Beijing capitalized on perceived declines in US global influence to expand funding for development projects.

Energy projects led the growth, reaching $93.9 billion—the highest since the BRI's launch—more than double 2024 levels. This included $18 billion in wind, solar, and waste-to-energy initiatives, reflecting China's dominance in clean technology. Gas megaprojects dominated, alongside metals and mining investments that hit a record $32.6 billion, focused largely on overseas minerals processing to secure resources like copper amid rising demand from AI-driven data centers.

Major examples included a gas development in the Republic of the Congo led by Southernpec, Nigeria’s Ogidigben Gas Revolution Industrial Park by China National Chemical Engineering, and a petrochemical plant in Indonesia’s North Kalimantan by a Tongkun-Xinfengming joint venture.

“The megaprojects are something we hadn’t seen before,” said Christoph Nedopil, the study’s author and a China energy and finance expert at Griffith University. He noted greater trust from developing countries in Chinese firms to handle larger-scale projects, as these companies have grown in capacity and seek bigger opportunities for expansion.

Cumulative BRI contracts and investments since the program's 2013 launch under President Xi Jinping reached nearly $1.4 trillion, with 150 partner countries. The initiative has positioned China as the world's largest bilateral creditor while deepening economic ties in the developing world.

The scale has prompted concerns about debt sustainability for recipient nations, opaque terms, and strategic implications, including limited reciprocal market access and potential military-civilian overlaps in infrastructure.